What is Corporate Governance?

.png)

Strategic corporate governance is something we have probably all heard of, but how many really know what it is? Particularly environmental, social and corporate governance. A few years ago I set out to research the effects of corporate governance on the strategic role of boards.

But, what is Corporate Governance?

Searching the concept of corporate governance for a clear corporate governance definition, I soon found that contemporary corporate governance literature cuts across disciplinary boundaries of economics, business, and management. A globally recognized definition is evasive, because corporate governance considers the circumstances, traditions, and practices of the country in question. Perhaps the most famous definition of corporate governance was provided in 1992 by the so-called Cadbury report, The Report on Financial Aspects of Corporate Governance. It defines corporate governance as ”the system by which companies are directed and controlled”.

The impact of an Ownership Strategy on corporate governance

The foundation of corporate governance is ownership. Separating the ownership and control of the company is a common practice in modern corporate governance. It keeps the owners out of managerial responsibilities and empowers directors to take decisions to run companies. The owners' role in governance is therefore to appoint the directors, and boards of directors are responsible for the governance of companies. This means that when ownership and control are separated it creates a situation where company owners have limited influence over its management.

Owners generally exercise their authority through agency, the board of directors, that is placed above the company’s management. However, when the control and management moves from the owners it can create an agency dilemma. Suffice to say that there are costs associated with the separation of ownership and control, including agency relationships. An agency relationship can be conceived of as a contract under which one or more owners engage agents, their directors, to perform some service on their behalf. It involves delegating some decision-making authority and duties to the directors.

The ensuing problems in this relationship relate to the divergence of attitudes toward risk and agency problems. The agency problems arise from incomplete and asymmetric information as owners attempt to motivate directors to act in their interest. Owners of a firm often cannot observe directly, easily and accurately the key day-to-day decisions of management. The issue is twofold, first is the difficulty and cost of overseeing the director’s actions while the second is the relationship between owners and directors, particularly if the director does not act in the best interest of the owner. What is in the best interest of management is not necessarily the same as the optimum interests of owners. So what is needed are a transparent set of rules that provide a necessary framework for delineating powers and generating trust between the directors and the owners of the company. This comes down to good corporate governance.

There has been a growing discussion in recent years about good governance. During the 2008 global economic crisis, corporate governance came under intense scrutiny and stakeholder trust in companies was diminished. At the same time, misalignment between owners, managerial failures and organizational shortsightedness were detrimental to the wealth and welfare of companies. Following the economic crisis, there has been an increased call for corporate accountability to enhance trust and long-term ownership commitment. This calls for good corporate governance where the owners’ goal is that their companies are run professionally and transparently. That will ultimately establish stakeholders’ trust in the management and operations will be held responsible, acknowledging that companies face stakeholders other than owners.

While corporate governance is the system that companies are directed and controlled by, mechanisms for governance provide owners of a company some assurance that managers will strive to achieve outcomes that are in the owners’ best interests. Internal mechanisms include organizational strategy and structure, board of directors, executive compensation and auditing. The increased call for accountability on behalf of owners suggests that there is room for developing new governance mechanisms. To achieve this urgent development, technology is of great necessity. A Strategy Execution Management tool is what your strategy needs for corporate governance.

Following the crisis, one such was developed in Iceland; An Ownership Strategy, aimed at affecting the strategic role of boards. And as I had set out to do research on the effects of corporate governance on the strategic role of boards the Ownership Strategy of Reykjavik Energy caught my attention.

Ownership Strategy and corporate governance examples

As corporate governance examples go, Reykjavik Energy energy is ideal. An Icelandic power and utility company, it was on the brink of bankruptcy in the wake of the economic crisis. Lack of strategy, unclear responsibilities, and the circumvention of good corporate governance led the company into serious difficulties. These difficulties were reflected in non-transparency, managerial failure and complete loss of trust of the company’s many stakeholders. In the aftermath of the crisis the owners formulated an Ownership Strategy in an attempt to restore trust in the company. This was the first Ownership Strategy for such a company in Iceland.

The Ownership Strategy is not a strategy in itself, it is a governance mechanism that lays the foundation for good governance, long-term results and sustainable strategic management of the company. An Ownership Strategy sets out the mandate and roles of the company and its owners in a transparent way. It also limits somewhat the mandate of the board of directors by stipulating that certain decisions are subject to owners’ consent. With the Ownership Strategy the owners take on a more active and responsible role, it represents their collective ownership commitment and responsibility towards their company; active and responsible ownership.

Responsible ownership unites owners and promotes alignment between them, while maintaining a long-term focus. By working together rather than battling competing interests the owners are able to communicate their shared will and long-term visions to their board of directors. The Ownership Strategy acts as a collaboration pact that expresses the owners’ will while at the same time it acts as a guide to the board of directors supporting the effective board decision making that is crucial to good governance. By providing a clear direction to the directors it allows for constructive cooperation to advance the company.

However, an Ownership Strategy is a novel governance mechanism that hasn’t been explored and discussed in depth, neither within literature nor among practitioners. Without such discussions practitioners miss out on the opportunity to apply this mechanism to the betterment of corporate governance. For this reason my research focus shifted to exploring the workings and effects of an Ownership Strategy on the strategic role of boards.

Having described the concept of an Ownership Strategy above and the research objective, the attention is turned to the effect it can have on board behaviour and strategic decision-making; Effectively ”strategic corporate governance.”

Strategic corporate governance

The Reykjavik Energy Ownership Strategy is now central to the company’s overall governance. While it guides the board of directors along a certain path, the board has the duty to formulate objectives within the long-term vision and restrictions the owners have put on their mandate. Having a clear mandate, although restricted, assures the board of directors that they are working within the will and vision of their owners and it improves the working relationship of directors, making strategic decision-making easier and more effective.

While this sounds appealing, having an Ownership Strategy as a corporate governance mechanism is a choice. Yet it is not enough to have an Ownership Strategy. You need a board that adheres to it and actively implements it. Its implementation affects board processes and especially board involvement in the process of strategic decision-making. With an Ownership Strategy affecting strategising within the company in accordance with the owners’ will and vision, it has a direct effect on strategic management; applying governance to support the execution of corporate strategy, thus ”strategic corporate governance.”

If effectively implemented, Ownership Strategy can increase transparency and build the reputation of the company while increasing stakeholders trust in it. For effective implementation the board of directors needs to establish a system of processes and procedures (strategic corporate governance) in line with the Ownership Strategy. This system provides the corporate governance and compliance framework under which the Ownership Strategy functions and reports. The rules of procedure established by the company’s board need therefore not only be set out in line with the country’s Corporate Governance Guidelines, ensuring that the board fulfills its regulatory and supervisory functions, these rules of procedure also need to ensure compliance with the the Ownership Strategy. Complying with the Ownership Strategy includes the boards’ responsibility for formulating particular policies, the corporate strategy and future vision. All of these then need to be approved by the owners of the company.

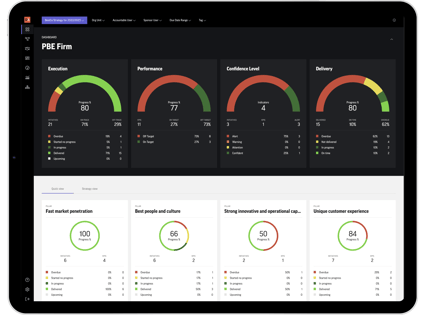

The documented strategic corporate governance process entails continuous revision of strategy and policies to ensure agility and focus on correct objectives to move the company forward to its owners’ vision. Then in order to reach those objectives the company’s executives need to present the board of directors a yearly plan of strategic initiatives. These initiatives secure the implementation of the owners long-term vision outlined in the Ownership Strategy. These strategic initiatives are accounted for and kept track on their progress with the digital strategic management tool from DecideAct. This process allows the executives to report to the board of directors on the Ownership Strategy’s implementation progress. In turn this practice enables the board of directors to have the necessary oversight to fulfill its obligations and inform the owners on the compliance to the Ownership Strategy with a yearly report made available to all stakeholders on the company website.

Exploring the Ownership Strategy ‘in action’ the results of my research show that the effective implementation of the Ownership Strategy, the company’s strategic corporate governance, has significantly improved good governance within the company. It showed to be an effective governance mechanism to unite owners and promote their long-term commitment to the business. Also it improved the working relationships between owners, and owners and their board of directors, allowing for effective decision-making. It also promoted stakeholders’ trust in the company by addressing and resolving the key points that led the company into difficulties following the economic crisis; a clear strategy along with transparent and strategic good corporate governance.

While the results showed a positive impact of Ownership Strategy on board decision-making, the inherent responsible ownership leads to owners placing emphasis on more than mere financial performance, demonstrating ambition towards sustainability and social responsibility. With these findings in mind I also sought to explore whether an Ownership Strategy could strengthen company’s strategic commitment to the United Nations Sustainable Development Goals (SDGs) and Environment, Social and Governance reporting (ESG).

Environmental, Social and Governance Commitment

The United Nations 17 Sustainable Development Goals (SDGs) adopted by all UN members provide a shared blueprint for peace and prosperity for people and the planet, now and into the future. But the United Nations acknowledges that progress on the SDG agenda is too slow and change needs to be accelerated. The question remains; How can change be accelerated? Recent research highlights the importance of collaboration in governance for sustainability and emphasizes the ability for related stakeholders to collectively work together towards a common vision, thus determining the effectiveness of chosen interactions or interventions. The Ownership Strategy might provide a collaborative opportunity for stakeholders.

With an Ownership Strategy containing the owners’ responsible commitment to the environment, social causes, and governance guidelines, my research findings suggest that collective action can be solidified through an Ownership Strategy when owners and stakeholders are clear on their roles and purpose. An Ownership Strategy with these elements helped strengthen the company’s commitment to SDGs and ESG reporting. The Ownership Strategy extends profit maximization objectives to encompass sustainable factors, promoting the sustainable success of the company. Emphasis on the SDG and ESG force high-level reporting on funds allocated to environmental resources and their use also encourage fiscal responsibility. Strategic corporate governance, rooted in the Ownership Strategy’s implementation process, and reporting with the digital strategic management tool from DecideAct, support an effective ESG reporting on all strategic initiatives supporting the SDG’s.

Exploring the Ownership Strategy it showed how collective action, forged through an Ownership Strategy, can strengthen the approach to SDGs and ESG and lead to benefits. My research suggests that owners interested in promoting long-term commitment with a focus on sustainability, improved relationships and strategic decision-making, should encourage the formulation of an Ownership Strategy. Therefore my ambition is to present these research conclusions and to encourage the formulation of an Ownership Strategy to the betterment of strategic corporate governance.

.png?width=596&name=Ownership%20Strategy%20(1).png)

.png?width=80&name=What%20is%20Corporate%20Governance%20(1).png)