What is a Financial Strategy and how you can benefit from it

.png)

Central to any business success is a strong and effective financial strategy plan. This is not a point of conjecture or an observation with grey areas, it is a plain statement of fact!

And this is because the very best product, finest service, most talented workforce and dynamic organization will buckle and break under the weight of a flawed corporate financial strategy.

A business financial strategy outlines and organization’s goals and plots the path to achieving those goals in a way that incorporates all matters of budgeting, investing, and saving. These keeps the business buoyant and able to optimize financial resources for stability, growth and the attainment of strategic goals.

What is a Financial Strategy Plan?

A comprehensive financial plan is all about managing a company’s finances in such as way as to deliver long term success. This means maximizing the return on investments and focusing on long term gain as well as short and medium term security,

A financial strategy plan and strategic financial management is ultimately and broadly about creating profit by ensuring decent return on investment (ROI), which is achieved through the establishment of financial plans, financial controls and sound financial decision making.

Components of a Financial Strategy Plan

An organization will need to understand its resources so it can maximize them creatively, accurately, appropriately and efficiently to best reflect its needs and goals. It is never as easy as banging square blocks into square holes and round blocks into round holes as goals and resources differ from company to company, however a financial plan commonly includes:

Goal setting and planning

- Define objectives clearly and precisely.

- Identify potential resources and quantify what is available.

- Create a dedicated business financial strategy.

Budgeting and cash flow management

- Help the company function with financial efficiency and reduce waste.

- Identify areas that incur the most operating costs, or exceed the budgeted cost.

- Ensure sufficient liquidity to cover operating expenses without tapping external resources.

- Uncover areas where a firm may invest earnings to achieve goals more effectively.

Risk Management

- Identifying, assessing and analyzing financial risks and mitigating uncertainty in investment decisions.

- Evaluate the potential for financial exposure; examine capital expenditures (CapEx) and workplace policies.

Establishing Ongoing Procedures

- Collect and analyze data.

- Make financial decisions that are consistent.

- Track and analyze variance, that is, differences between budgeted and actual results.

- Identify problems and take appropriate corrective actions.

Benefits of a Financial Strategy

The benefits of setting out and implementing a business financial strategy are multiple and crucial to solidity and both short and long term success.

- Financial stability and security: This is achieved through cash flow management and budgeting, building emergency funds and thereby minimizing financial stress and uncertainty.

- Goal achievement and wealth accumulation: This means setting clear financial goals, aligning resources to those goals, building financial buoyancy through disciplined saving and investing, and maximizing returns.

- Financial freedom and debt reduction: This is attained through a debt management plan, avoiding excessive borrowing, paying off high interest debts, keeping the debt burden in a reduced and manageable state.

- Risk management: Evaluating financial risks, evaluating insurance needs and coverage, safeguarding against the unexpected events that could lead to unforeseen fiscal input.

- Taxes: These can be the undoing of many a company so it is crucial to understand tax regulations, structure investments and financial decisions to minimize tax liabilities whilst being able to maximize after tax income.

Strategic and Tactical Financial Management

For strategic management of finances an organization must be able to accurately assess the current financial situation by analyzing income, expenses and debts, allocating necessary financial resources and monitoring expenditure and cash flow. Through this process it is easier to identify underlying strengths and weaknesses and enable the company to keep moving towards its goals.

A strategic financial plan means being agile enough on an ad hoc basis to react and respond to short term issues while keeping the long term vision intact and continuing the course towards that goal. This might even involve sustaining short term losses if it is all part of the longer term plan for success.

Tactical financial management is about short term positioning and acting in a way that may satisfy shareholders, for example, but must still be part of the greater strategic scheme.

How to develop an effective financial strategy

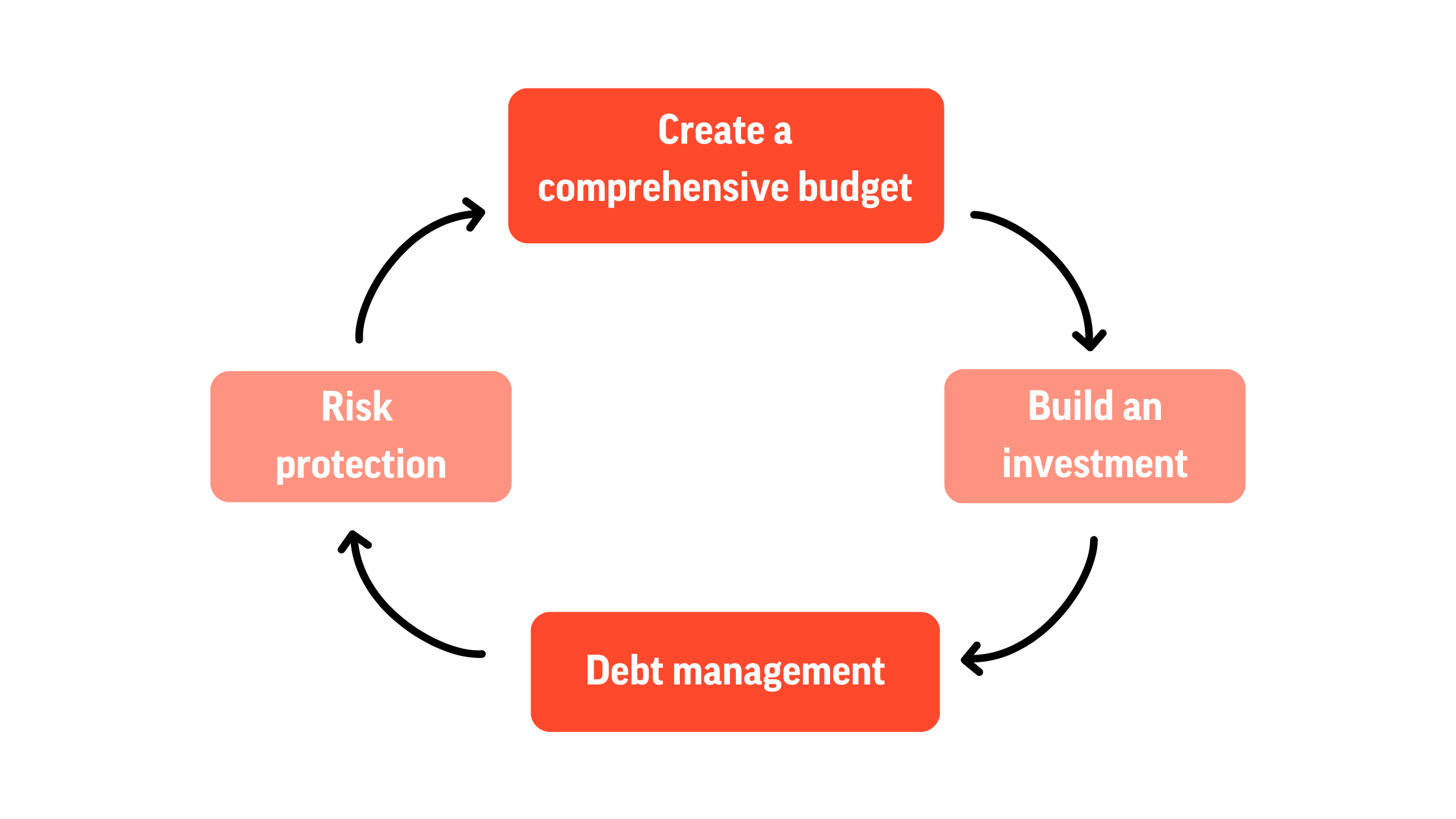

Create a comprehensive budget

A proper budget will require the accurate tracking of expenses and income, identifying areas of saving and cost cutting and the allocating of funds for specific goal driven activities.

An emergency fund is a critical safety net that can make sudden shocks to the system manageable and allow the company to keep moving forwards in its strategic direction. An emergency fund within a financial strategy plan means establishing the right amount for emergency savings and ensuring that there can be quick access to these funds should they be required.

Build an investment plan

Understand investment objectives, asses risk tolerance, diversify investments across asset classes and keep the investment portfolio under constant review and be ready to re-balance when necessary.

Debt management

Debt is an every day factor in any organization and it needs to be kept on top of. This can be achieved by evaluating different types of debt and interest rates, developing a debt repayment plan strategy, keeping clear of unnecessary debt and high interest loans.

Risk protection

Risk protection wherever possible is crucial to stability and a sound financial strategy. Central to this is pinpointing potential risks and vulnerabilities, securing appropriate insurance coverage and keeping these policies under regular review.

The first step in devising a financial strategy plan is setting measurable and clear goals.

Any and every strategy has goal setting at its heart and a financial strategy is certainly no different. Whether those goals are expanding a business or making relatively small personal savings, the goals should be clear, specific, appropriate, achievable and operate within a workable time frame. Clearly defined goals will ensure that an organization or individual will understand the aims and processes while the correct prioritizations and resource allocations are made.

1. Clearly defined goals need a budget

A financial strategy needs a detailed plan that outlines the key elements of income, expenses and savings over a period of time. This allows an accurate tracking of financial movements in and out, allowing quick awareness of overspending or even under spending and therefore the appropriate measures to be taken to ensure everything remains on track to achieve strategic goals. The budget must be easy to review and adjust as necessary to remain effective.

2. Investment planning is a core activity with a financial strategy plan

Effective investment means growing wealth and helping achieve financial objectives by identifying appropriate investment opportunities that have suitably survived risk tolerance tests. In corporate terms this might mean expansion, acquisitions and diversification projects. Risk and reward has to be seen clearly and the balance between the two firmly understood as a diversified portfolio can be developed to manage risk effectively.

3. Risk and reward

But only when risks are managed properly! Protecting against the unforeseen and events that could have a negative impact on company stability is critical. Identifying potential risks such as looming economic downturns and trend shifts in your market sector and being in a position to able to weather natural disasters and unexpected expenses.

Some things are not in our absolute control but making sure a company is in the best position to deal with sudden jolts is part of a financial strategy. Insurance is an area where control can be taken over matters of property, liability, health and business continuance. Appropriate contingency finances enable an organization to ride out emergencies and unwelcome events, while maintaining its strategic path to its goals.

High profile example of a successful business financial strategy

When it comes to picking a corporate financial strategy there are of course many to choose from, but perhaps few are as relatable and current as Apple Inc. - one of the best known, most successful and valuable companies in the world that, one way or another, plays a part in many of our lives.

As you would expect, its financial strategy has been crucial to success. Lets take a closer look at it…

Apple’s financial strategy has placed diversification of products and services at its heart while keeping a constant emphasis on innovation. This necessitates continuous investment in research and development and production which has helped ensure a competitive edge in the market, keeping ahead of competitors and generating new revenue streams.

By setting itself as a premium price product and service Apple sets higher price points and has forged an unashamed reputation for quality. This has resulted in high profit margins and a consistently strong financial performance in an increasingly competitive market.

Apple places a strong emphasis on efficient supply chain management to optimize production processes while keeping control of costs. Its just-in-time inventory system means there are minimal holding costs.

Recurring revenue streams through its global services such as Apple Music, iCloud and the App Store means steady, reliable revenue, healthy cash flow, the generation of significant cash reserves and less reliance on hardware sales. These cash reserves are applied to such areas as ongoing R&D and strategic acquisitions and this capital allocation enhances shareholder value and supports long term growth.

Apple’s financial strategy of innovation, diversification, supply chain management and disciplined capital allocation with a focus on premium products, recurring revenue streams and international expansion, has allowed it to achieve the position of market leader with continued, sustainable growth - something only possible through an effective financial strategy.

Make your Financial Strategy Plan a reality with the DecideAct software. Test it out today!